A person's decision about how many credit cards they have should be made is very personal. It will depend on how your credit is managed and your financial situation. Your credit score also depends on it. Your credit score can have a big impact on your ability to buy expensive items and get a mortgage.

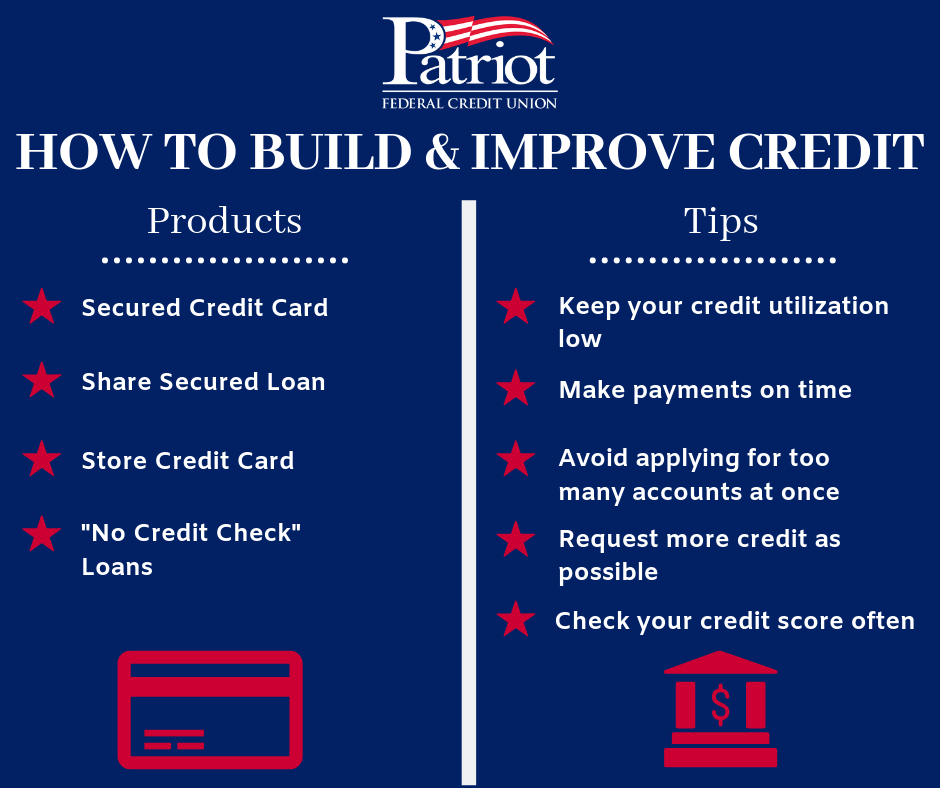

Avoid applying for too much credit cards at once

Too many credit cards could cause credit damage. A single inquiry can affect your credit score by five to ten points. Multiple inquiries could lower your score two-fold or triple. Multiple inquiries could raise red flags from lenders. Multiple applications for credit cards can indicate that you may be overextending yourself.

If you already have a card, wait before applying for another. Too many applications will hurt your credit score and your approval chances for other credit. You should also keep your existing cards open. Lenders love to see a history of credit. It's better to have multiple accounts than none.

It can be difficult to apply for too much credit cards at once. Not only will it affect your credit score, it can also make it look like you are a risk to other card issuers. This can make it appear that you are a high-risk credit hazard and is more likely to end up in debt. Additional credit inquiries may result in multiple applications, which can negatively affect your score.

Avoid more than two credit card accounts

It may be tempting to have too many credit cards. However, this can lead to problems for some people. The number of credit cards that you should have will depend on your financial status, spending habits, credit history, as well as your credit history. Keeping an eye on balances and payments is important, as is paying the balance off each month in full. It is also important to examine your credit reports in order to avoid late fees.

To avoid interest charges that can harm your credit score, you must make sure your card balance is paid in full each month. It's also a good idea to pay more than the minimum amount due on your cards, as this will improve your credit score. Your credit utilization ratio (also known to be total credit-to–debt ratio) is a key factor that can influence your credit score. Therefore, it's important to keep it under 30%.

Avoid too many secured debit cards

Although secured credit cards offer many benefits, they also come with their own drawbacks. For example, some charge a large annual fee or a high application fee. It is crucial to compare interest rates to determine the one that best suits your needs. A secured card can have a lower credit limit but you can increase it by making consistent payments. It doesn't matter what card you choose; make sure that you pay your balance in full each monthly. This will help keep your credit utilization rate low and avoid paying interest.

Secured credit cards may improve your credit score but it is unlikely you will be able exceed a certain threshold by solely relying upon these cards. This is because these cards have a lower credit limit, making it difficult to keep credit utilization low. However, secured cards are the most common credit cards that you will have when building or establishing credit.