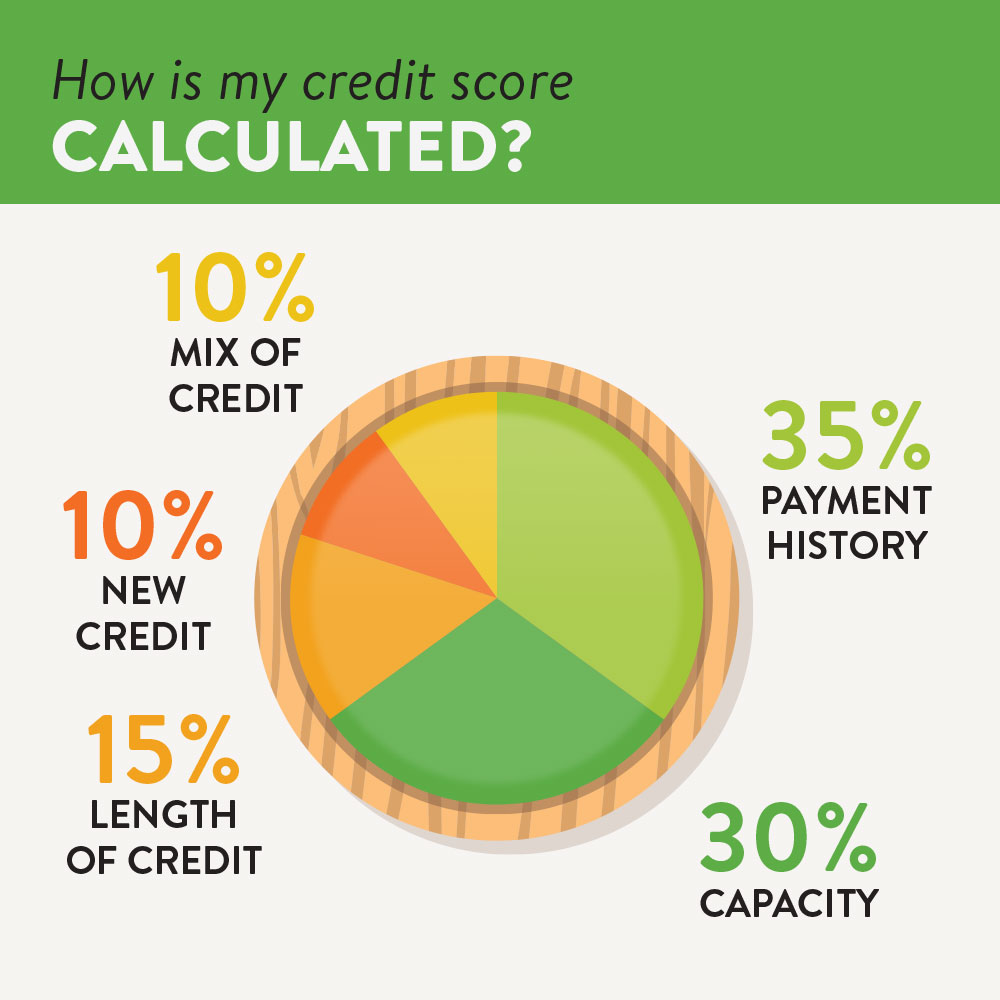

The Discover credit score is calculated based on several factors. These include your income, debt and home ownership. A minimum credit score for Discover credit cards is 640. However, it's possible to have a lower score if you aren't a bank customer. Discover will consider several factors when determining your score. This will help to improve your credit score.

Discover Bank

How is your Discover Bank score calculated? There are many factors that go into determining your score. These include your recent credit card applications and your income and debt ratios, as well as your credit history. Some credit card issuers may also look at whether you've had any strained relationships with other companies. Your credit score may be affected if multiple accounts have been closed recently or you have paid late. Discover's criteria are flexible. If you meet these requirements, you should be able to get approved for a card.

The monthly free access to your Discover Bank credit score should be unchanged. Although Discover continues to offer this service, it has modified its strategy. It's still available on your statements and app. Current customers now have a monthly free access to their FICO score. You might be wondering where you can get your credit score free of charge if they don't have it. These are some other options:

Free FICO score

Discover was the first credit-card issuer to offer a FICO scoring free of cost. This benefit is still available today and is based on your TransUnion credit report or Experian credit score. Other credit card issuers have followed suit and now most offer this benefit. But, this credit score is not a reliable indicator of your financial health.

This program will enable you to check your credit score free of charge every month. Discover will not rent or sell your information, unlike other credit companies. All you have to do is log in and view your free FICO score at least once a month. You won't have to pay anything, and you can review it as many times you wish. If you are unsure whether this program is right for you, it will be useful.

For most Discover credit cards, you need to have a minimum credit score

Most Discover credit cards can be applied for with a minimum credit score 670. Certain cards, however, require a higher score. A minimum 670 FICO(r score is required to be approved for a Discover Card. The soft credit test will not affect your score but will let you know which cards would be best for your situation based on your credit history, current debt and other information.

Many factors play a role in determining whether or otherwise you are eligible for Discover cards. They evaluate your income against your debt, your employment and home ownership status and the number of loans and credit lines you currently have. However, if you have an outstanding balance on several credit cards, your credit score may be a deciding factor. This is why you shouldn't apply for multiple Discover cards at once.

Scores for non-customers: Accessibility

Customers are more satisfied when your website is accessible. The most loyal customers will be the ones who promote your business. A user-friendly website is one of the key factors that will encourage a customer to become a promoter. Google's research indicates that seventy five percent of customers look at your website when assessing your credibility. Your credibility score will increase if your website is easy to use and helpful to all visitors.