It is understandable that a consumer with a low score might be anxious about how long it will take to improve their credit score. You'll find out below that there are many ways to quickly and easily raise your score.

How long will it take you to improve your credit score

After a financial emergency, it can be difficult to get back on track with your credit score. But this is not impossible. It's possible to achieve your goals with discipline and good habits.

Cleaning up errors on your report can help improve your score. Errors can include missing accounts, incorrect credit limits and even Social Security numbers that aren't listed on your reports. By law, the credit reporting agencies must correct these errors, but it can take time to do so.

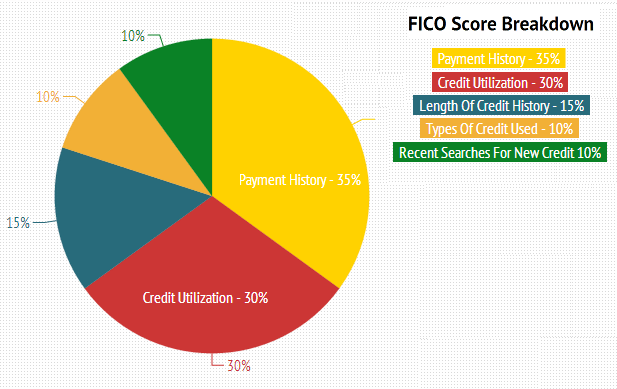

The ratio of credit used can also affect your score. To maintain good credit, experts recommend that you keep this number between 10 and 30%. If you want to lower your ratio, pay down your debt or request credit limit increases. The best way to achieve this is by making it a top priority to pay it off as soon as you can.

How long to increase your credit card limit

It's not easy to increase your credit limit. The company who issued your account must be contacted to request an increase in credit limit. It shouldn't take you more than one hour to do this, and it can help keep your credit usage ratio low.

How Long to Increase Your Credit Cards

The best way to quickly increase your score is to get a credit card. However, you must be careful when doing so. Too many credit cards will hurt your credit score. You should only have one or maybe two open at once.

How Long to Improve Your Credit History

You can also boost your credit rating by removing negative information from your report. It may take some time, but the effort is worth it if there are negative items on your report.

How long do you have to dispute credit errors?

While it's relatively easy to spot errors in your credit report, correcting them can be a lengthy process. A study by the Federal Trade Commission has found that 5 percent of consumers have errors on their credit reports, and those mistakes can be detrimental to your score.

You will have to prove someone else was responsible for the mistake if you want it removed from your report. Then, you can file a dispute with the credit bureaus to have it removed from your report. You can also contact your creditors and ask them to update their reports. If you are persistent, it can take six months or longer to remove a mistake from your credit history.