The best utilization ratio for your credit score is low. Schulz recommends that this ratio should not exceed 30%. It can even reach 30% before it impacts your credit score. In order to avoid credit card debt, you should limit your credit card usage to 30%. However you should always pay your entire balance each billing cycle. Here are some tips to achieve a low utilization ratio.

A low credit utilization is better than zero.

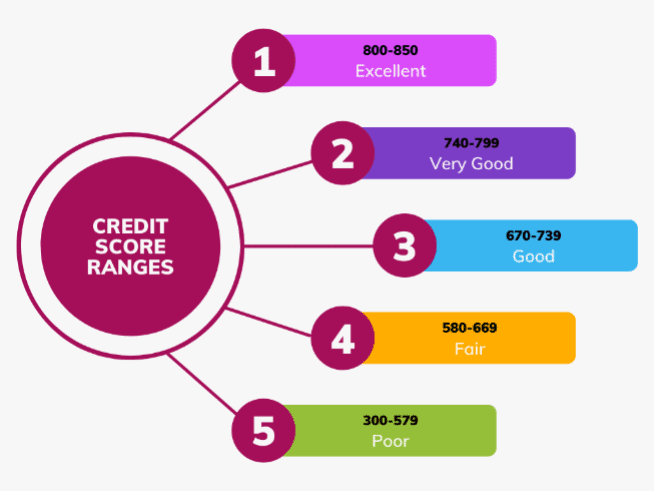

Low credit utilization ratios are better than zero debt. This is an important question because your credit score will depend on it. You can achieve and keep a high credit rating by understanding the reasons why it is important. A high credit score is essential to get credit when you need and to reach your financial goals. How do you determine if a lower credit utilization ratio is better for your financial goals than zero debt.

Paying off your outstanding balances is one way to increase your credit utilization ratio. While credit cards can seem tempting, it can also lead to excessive spending. Avoid falling for this trap as it could have negative consequences on your financial health. Moreover, opening new accounts can lower your credit score. However, opening new accounts can lower your credit score.

It is a sign of financial management

Your credit utilization ratio will tell you a lot of things about how you manage your money. It's not the only factor lenders consider. The credit score is just one factor. A low credit utilization rate is ideal, while a high percentage is an indicator that you may not be properly managing your finances. Good news is that a utilization rate below 30% is the best. It is important to note that there are not any hard and fast rules regarding this metric.

Low credit utilization may indicate poor financial management. It can make it more difficult to get loans or credit cards. There are several ways to reduce your credit utilization ratio. First, you can apply for more credit. Creditors will typically increase your credit limit if you pay your bills on time and don't exceed your credit limit. Remember that multiple inquiries can lower your score.

It plays a significant role in determining whether or not you are eligible to receive a mortgage.

Your credit utilization ratio is one factor lenders will consider when deciding whether you apply for a mortgage. This simple metric shows how much credit has been used and how much borrowed. The ratio is simply this: If you have a $10,000 credit limit and only use $2500, then your credit utilization is 20%. This ratio is taken into consideration by lenders who will ask you to provide proof that your ability to pay your balances on the due date.

There are many things you can do in order to increase your credit utilization ratio. The first of these is to pay off large purchases. This will prevent your credit utilization ratio (credit utilization) from rising by paying off large purchases quickly. Pay off large purchases before the due date for any credit cards. This will keep your credit bureaus' high utilization from being reported. Take action quickly only if you plan on applying for a mortgage in the near future and keeping your credit score as high as possible is important.

Calculating it

The credit utilization ratio is the percentage of credit used compared to the total amount of available credit. You simply need to add up all the balances on your credit cards in order to calculate this ratio. Logging into your credit card accounts will often reveal these limits. Once you have these numbers, you can multiply them 100 times to determine your total credit utilization. A credit utilization percentage of 50% is a sign that you are only using half of your credit.

Two easy ways to increase your ratio are increasing your credit limit or decreasing credit usage. The safest way to do so is by charging less than you normally would. You will be able to get credit at a lower rate by using credit cards smartly. Here's how. This strategy will increase credit utilization and reduce your spending. Once you are proficient in maximising your credit limit, your credit score will improve and you will be able to enjoy better terms.