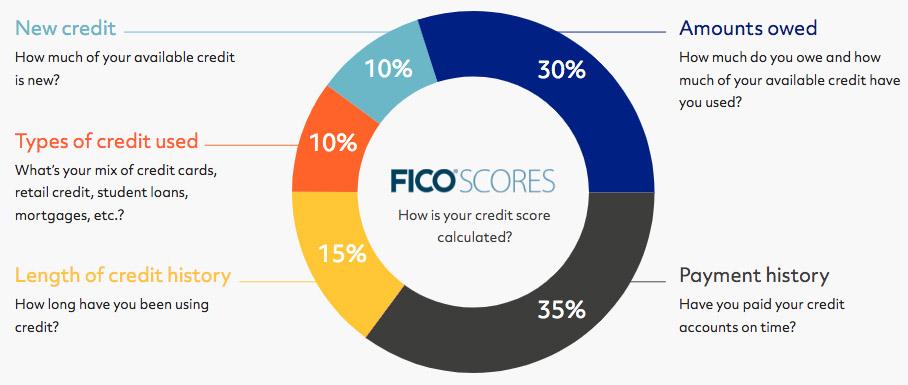

Credit cards are the easiest way to pay for purchases. These cards can be used for everything: from booking travel to paying bills. Some credit cards even offer rewards for spending. These points can be valuable in building a credit score, which is a key factor in receiving approval for credit cards. A secured or an unsecured credit card can be applied for.

Capital One Quicksilver Rewards Credit Card

Capital One Quicksilver Card: If simplicity is something you value in your financial life, this card might be for you. The card offers a flat reward rate that makes it easy for you to track how much you earn. It doesn't have any interest or annual fees. You can get a $200 line of credit for as low $49.

Capital One Quicksilver cash rewards credit card offers 1.5% cash back for all purchases. You can redeem your rewards in the form of a check, statement credit, or gift cards. Cash back is valid for as long as your account is active. You can also apply the cash back to previous purchases. This will allow you to reduce your credit card statement.

Indigo(r) Mastercard(r) Credit Card

The Indigo Mastercard is not a reward card, but you can still use it for building your credit and financial habits. Credit limits are $300 so it is important to only purchase items that you can afford to pay in full when you get your statement. Late fees are avoided by paying your bill on-time. Remember that a credit card with high interest rates is not the best way for you to build credit.

The process of applying for an Indigo Masterscard is very simple. An Indigo Mastercard application requires that you are 18 years old and possess a valid social safety number. Indigo will conduct soft credit checks to verify your identity once all the items are provided. Indigo does not accept requests for credit over the telephone, nor paper applications.

Wells Fargo Business Secured Visa Credit Card

Wells Fargo Business Secured Visa Credit Card for Business Owners with Bad or No Credit is available. It offers a variety of unique features. The cards are available at low interest rates with no annual fees. Additionally, the company offers a rewards program to reward customers for making purchases. You will earn one point on every dollar you spend with the Wells Fargo Business Elite Card. If you spend $10,000 in a billing cycle, you may be eligible for up to 5,000 bonus point.

It's not hard to get a card. For business owners with poor credit, there are many options. The Wells Fargo Business Secured Visa Credit Card is a great place for them to start. This card is free of annual fees, making it one the easiest credit cards you can get.

Chase Sapphire Preferred(r) Card

The Chase Sapphire Preferred Card will be the best option for you if credit is good. Although some people think that applying for a Chase Card is difficult, it's not. You only need to have a certain credit rating and complete an application. To improve your credit score, you might consider competing with other credit companies before applying for a Chase card.

This credit card has a wide range of benefits, including travel insurance, travel protection, as well as transferable points. You can also earn up to 25% more rewards by signing up for the Pay Yourself Back program. In addition, you will receive $200 cash back after you spend $1500 within six consecutive months.

Citi Double Cash card

Citi Double Cash Card makes a great choice if you have high-interest credit cards balances. It has a low balance transfer fee and an 18-month, 0% introductory APR for balance transfers. Other benefits include $0 fraud protection and 24-hour fraud insurance. You can use your card to purchase tickets for presale events.

This card is great for people who spend on a daily basis and want a card that earns cash back. You get a solid cashback rate on all purchases, and there are no rotating categories or cashback calendars. It also offers a great balance transfer APR period, which allows you continue to use the card even after you have paid off your debt. Its rewards structure is simple and straightforward, which can help you stay out from debt and avoid any interest-bearing credit cards.