There are many differences in a credit report and a score. The credit score can be calculated based upon your credit activity. A credit report, however, contains information about your payment history. In this article, we will discuss the differences between these two documents and how they are different from one another. This article will also give you some insight into the role of your payment history in your credit score. Continue reading to learn even more. These are the main differences between a credit score (or credit report) and a credit score.

There are some differences between a credit score, and a credit report

You may have heard credit scores. However, you don't know what to do with them. There are some key differences between a report and a score on your credit card. Your credit score is a numerical assessment of your financial history, based on past behavior. While a credit file provides more detail about your financial history, a score on credit is a single numerical number that lenders use for determining if you're a suitable candidate for credit.

Credit reports provide information about a borrower's past history of borrowing money and paying it back. Credit scores are three-digit numbers that lenders use to determine a borrower's credit worthiness. Your credit report contains information about your accounts as well their age. Your credit report may also include negative information, like delinquent payments. Credit scores can be good to excellent in general, but they can vary greatly.

Information in credit reports

A credit report includes information on your financial history, such as how much you've borrowed and repaid, how many accounts you have open and closed, and whether you've had any delinquent payments. You can also see if you've ever applied for credit. This information could be on your credit report for years. This information is used by financial institutions to determine whether they will extend credit to you. You can request a copy from your credit report to your landlord or employer.

Your payment history is one the most important pieces in a credit report. This includes any accounts that were opened during the past seven to ten-years, and joint accounts that have been authorized users. Your credit history also includes your repayment history, including installment loans and credit cards. Additionally, any judgments or taxliens will be listed on your credit report.

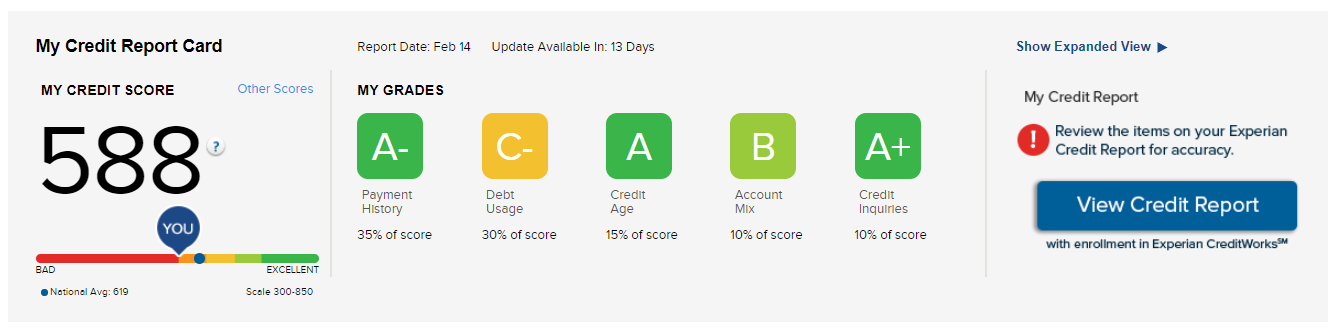

The impact of payment history on credit scores

Your payment history is one of the most important factors in your credit score. Late payments can damage your credit score and be visible on your report for up to seven year. A few slip-ups can not harm your credit score but multiple late payments can. Your payment history is a record about your payments to all your accounts including credit cards, personal loan, and credit lines. Lenders can see your payment history to determine how likely you are for default on your accounts.

FICO's 35% figure is only a guideline. Your actual impact might be greater or smaller. If you have limited credit history, a few late payments could have a greater impact than a long history of timely payments. In such cases, refinancing your current loan could be the best option. As mentioned, refinancing your existing loan could also improve your score. Refinancing either a home- or car-loan loan is a great option for improving your credit score.