When you're looking to repair your credit, you may be wondering how to go about it. If your credit is not good, you could ask a family member or friend for co-signing. This option will involve risk and full responsibility, as they'll be held accountable for the loan repayments. You should be cautious when applying for credit because of your poor credit history.

Pay back overdue bills

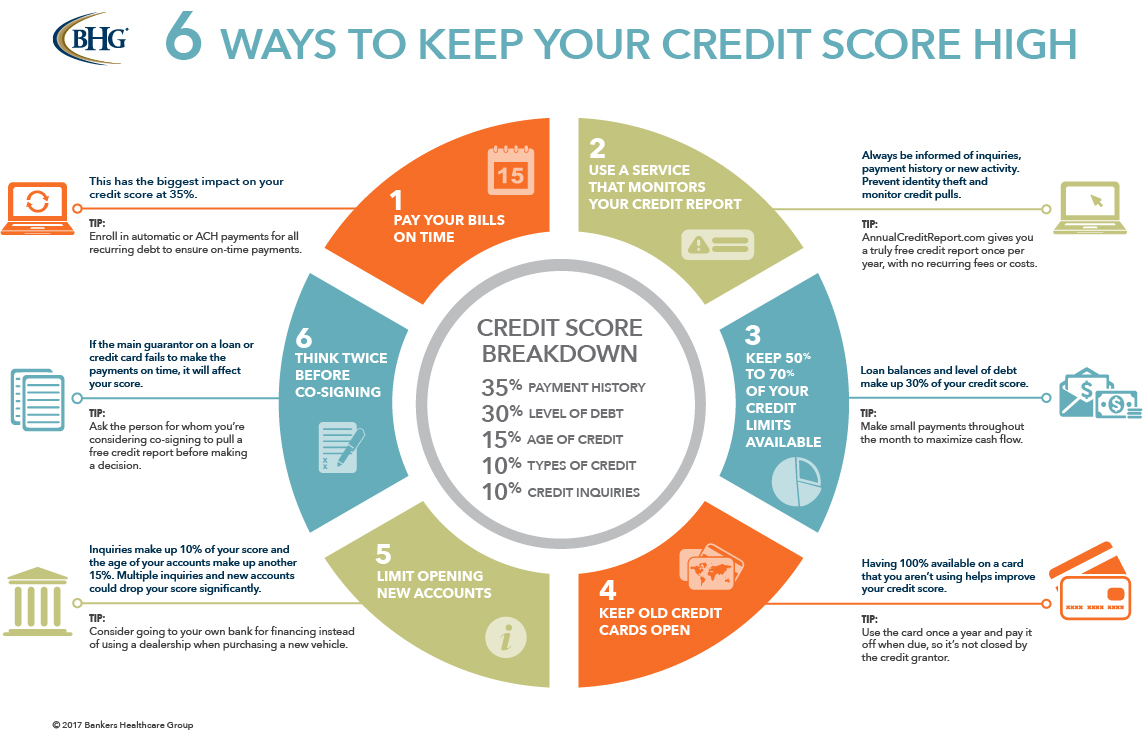

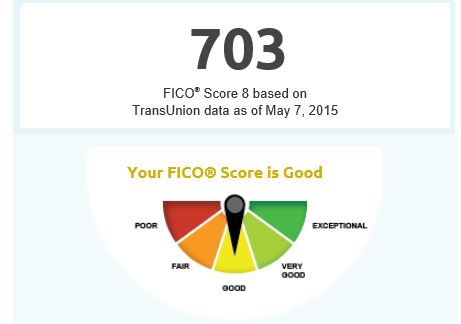

In order to improve your credit rating, it is important that you pay all outstanding bills. Paying on time is the largest factor that affects your credit score. Paying late can affect your credit score for seven and a quarter years. It will take longer to get removed from your credit report. Pay attention also to your credit utilization. This is the amount of money that you have left on your credit cards and loans compared to your total credit limit. It is more important to pay on time than to make late payments.

Your credit score will not be affected if you pay your bills on the due date. If you've missed multiple payments, your credit score will be affected for seven-years. You must make payments on all overdue accounts if your goal is to rebuild your credit rating. The best way to do this is to make minimum payments on all of your accounts. Make extra payments on your highest APR debt as much as you can, and repeat this process with all of your debts. Keep up to date on past-due payments. Late payments can harm your credit report.

Avoid late payments

Inaccuracies in your credit report can lead to late payments. By calling the credit bureaus, you can correct incorrect information. It is fast and free. It is fast and free. While it is tempting to make only the minimum monthly repayment, making a larger monthly payment will reduce interest fees.

Set up automatic payments to avoid late payments and rebuild your credit. Set up automatic payments if you don't have enough money to pay your monthly minimum bill. To ensure your bill is paid on-time, you can set up automatic payments on all accounts. You can also use multiple credit card if you are unable to do this.

Increase your credit score with a secured card

A secured credit card is a great way to improve your credit score. These cards are designed for those who are rebuilding their credit but don't have the same credit score as traditional credit cards. Because of this, lenders view people with low credit scores as high risks and often require a cash deposit before approving them. The bank is less likely to default on payments due to the deposit.

Your credit score is determined by many factors such as your payment history, credit history length, credit card usage, and credit cards used. Secured credit cards can help you build credit because they report your payment to the three main credit bureaus. On-time payments on your secured cards are the best way to build strong credit histories. The balance should be kept low. While you can use a secured credit card for everyday purchases, be careful not to exceed your credit limit, as this will appear as being credit hungry to the banks.

Before rebuilding credit, pay off any medical debt

Your credit report won't reflect medical bills. Therefore, you should pay your bills before rebuilding your credit. Here are some points to be aware of. These debts are not going to affect your credit rating. Hospitals make very little from the sale of your debt to collection agencies. In this case, hospitals will likely work with you to negotiate a payment plan or accept part of your payment.

You will see a significant improvement in your credit score if you pay off any medical debts before rebuilding your credit. The negative marks will appear on your credit report, but it will take longer. Further, your credit report will show the medical bills for seven more years. These debts will keep you from getting loans or credit card approvals, and make it harder for you to make hiring decisions. Although medical bills might not appear on your credit report as an important item, they can have a significant impact on your credit score.