You're not the only one curious about your Fico score. FICO's scoring methodology has been improved many times over its initial introduction in 1989. FICO is regularly updated and lenders use it to decide whether you should upgrade your FICO rating. Here are some facts about your FICO score.

Payment history

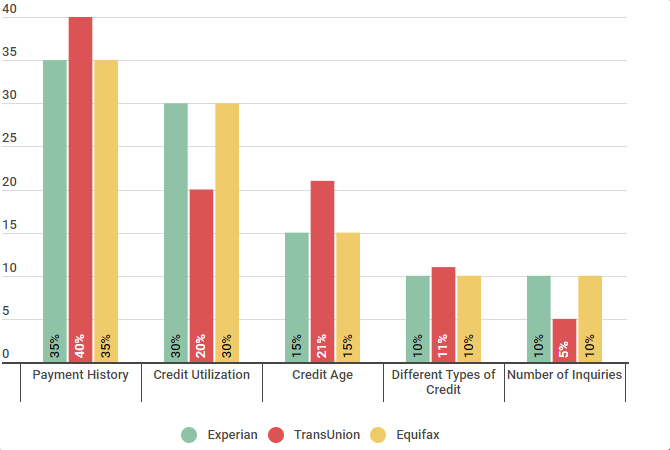

Your FICO score is determined by many factors, but the two most important ones are your credit utilization and payment history. Both of these factors depend on how much you owe relative to how much cash you have. Your credit mix is also a factor. It describes how many accounts and loans are available to you.

The most important factor among these is payment history. More than 90% of lenders use it to assess a potential borrower's credit worthiness. It is important to make on-time payments on all accounts, both current and previous. FICO research has found that a person’s past payment history is an excellent indicator of his or her ability to repay any debt. Collection accounts and bankruptcy are part of a person’s payment history and can harm their scores.

Accounts owed

FICO scores can be calculated by analyzing credit reports. These scores are divided into different categories depending on how much debt someone has and how frequently they have made payments. The payment history is an important factor as it indicates how well someone has been paying their debt over the years. Accounts owed reveals how much money an individual owes. It also shows whether or not they made any payments on time.

Fico scores, and accounts owed, are closely related. Each one can have an impact on the other. However, a high balance does not necessarily mean that you're in trouble. A high percentage does mean you're carrying too much debt, which can make it difficult to make monthly payments.

Credit history length

Credit score can be affected by many things, including the length of credit history. The longer your credit history is, the better. Because lenders are looking for long-term payments history, this is a good rule of thumb. Lenders also look at the frequency with which you have opened new accounts. Lenders may be concerned if you have not made timely payments in the past.

Although the age of your accounts may have an effect on your score, it is not as important as other factors. While it is possible to have a low score without having a lot of history, the longer your history is, the higher your FICO score will be. Your age also has an effect on the importance of other factors in your score.

Credit mix

Diversifying your credit sources is a great way to improve Fico scores. This involves taking out loans that are different from revolving credit. A combination of revolving and installment credit is the best credit mix. Even if you only have a modest credit balance, having both installment and revolving accounts will increase your FICO Score.

You should also open a credit account. This type revolving credit will increase your credit mix which is important for future loans applications. If your credit score is not yet high enough, you shouldn't apply for too many credit card applications. Rejections can be damaging for your fledgling credit score.

Credit card new

Your new credit score is an area of your credit report which contains information about new accounts. A new account can be defined as one you opened in the last six to twelve-months. Your score will be affected if your application is declined. This information can also affect your eligibility for new credit cards or loans.

The new scoring model is expected to affect more than 80 million consumers. Some will see their scores increase while others will see declines. People who are late on their payments will see a major impact from the changes. Personal loans pose a particular risk as they don't require collateral.