Are you wondering if your bank can tell me what my credit score is? Then you are in luck. Yes! It doesn't even need a credit card. You can also check your score whenever you want. Be aware, though, that the free scores on these sites are likely to be inflated by as much as 60 or 70 points.

TransUnion VantageScore

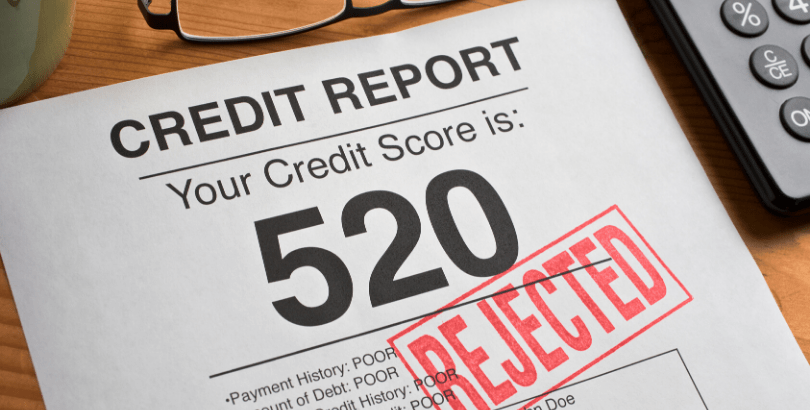

A credit score represents your credit history numerically. Your credit score is a combination of several factors. These include payment history and number of accounts. Your score is affected by the age of each account. It is also important to consider your mix of accounts. Your score is also affected by the total balances of your accounts, which makes up 11%.

No matter what bureau you are from, errors that affect credit scores can be disputed. Credit repair services can help you rectify any errors that you discover. VantageScore is growing in popularity, even though FICO scores are still the most popular.

FICO's FICO

There are many factors that determine your credit score. The bulk of your credit score is determined by the amount of money you owe as well as your payment history. The Fair Isaac Corporation created a mathematical formula in 1958 to calculate the FICO score. Your credit score will be higher if you have a better credit history. You can improve your score by paying off all outstanding balances and maintaining a sufficient credit limit.

Many banks offer credit score calculators, and they will gladly provide the result. The bank can also show you what credit score it prefers. FICO scores are used by most lenders to make lending decisions.

Experian’s VantageScore

The VantageScore is a credit score provided by Experian. It is based on your credit history and the latest balances on your accounts. It is important to have a high credit score in order to be eligible for a loan. If you owe more than you can afford to repay, your score will be lower. Paying off your debts can boost your score.

VantageScore's credit score is calculated using information from your credit reports. This includes information from lenders about whether you have paid on time. Not all financial institutions report to the three credit bureaus. Due to the fact that each bureau has a unique credit report, you may see differences in your score.

VantageScore is a VantageScore product by VantageScore

Are you concerned about your credit? If so, you might be looking for ways to improve your score. The best way to do this is to manage your finances responsibly. You must pay your bills on-time. To help you do this, setting up automatic payments or reminders will help you stay on top of your finances. Notifying your lenders if you are late on a payment is a good idea. This will ensure that they don't report your payment to the credit agencies.

Your credit score is calculated based on your payment history, including any late payments or collections. It also takes into account the type and age of your credit accounts. It's not a good idea to have a credit rating below 700. You should also avoid having too many debts.

Equifax's VantageScore

When applying for a loan or credit card you might wonder, "What is your credit score?" Equifax's VantageScore is a great tool to help you determine your credit score. The VantageScore takes six factors into account, including your payment history. You also need to consider your total credit available and the age of any credit accounts. A negative effect on your credit score could be caused by missed or late payments.

A lender might ask for information about your credit history and inquires, especially if you are applying to a mortgage. This is because your recent credit history is indicative of your future financial performance, and creditors prefer to see that you're taking out credit only when necessary.