A credit card can make a significant difference in your life. There are many credit cards from different financial institutions. It is important to research your options before you make a decision. Avoid picking the first card you see. Make your decision based on these five factors.

Take three steps to find the right credit card for you:

The first step to choosing a credit line is to decide what you really need. For example, you may want to have a rewards program or receive discounts at stores. You might also want a card that has low APRs, which can help you consolidate debt and pay it off cheaply. With these goals in mind you can start to compare credit cards and find the one that suits you best.

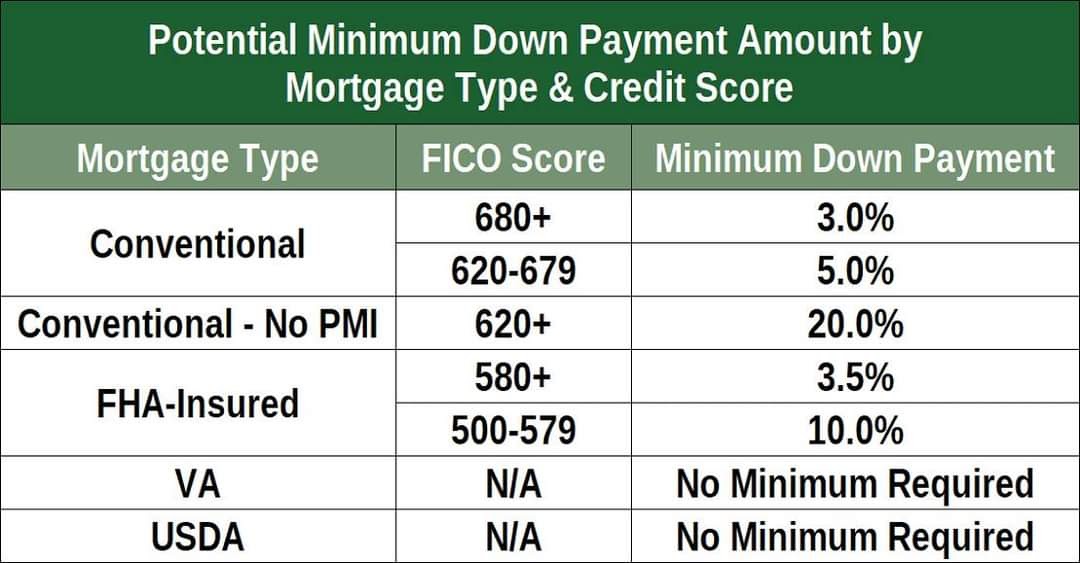

Checking your credit score is another step in choosing the right credit card for you. Your credit score will determine your eligibility for credit card. Different credit cards target different credit scores. Before applying for a card, it is important to check your credit score.

You should look for cards with low interest rates

A credit card that charges low interest rates is a smart choice for many reasons. These cards give you more flexibility in spending and can increase your credit score. These cards might offer lower interest rates along with travel and reward benefits. Be sure to review the terms and conditions before you sign up.

The annual percentage rate (APR), is something you should consider when selecting a credit line. This rate will determine how much you pay in interest on the balance if you carry a balance. If you plan to pay the balance off in full, it's important to choose a credit card with a low interest rate. Before you sign up for a credit line, compare the annual and interest rates. If you pay your balance in full each month, you should also look into rewards credit cards. These cards give you cash back or free traveling.

Consider rewards programs

Rewards programs should be considered when choosing a credit line. You can use them for many reasons and earn benefits on your everyday purchases. You may also be able to access airport lounges and special events with your rewards credit card. They can also be helpful for those who like to give back and choose to donate their points to a charity.

Research different reward programs to find the best rewards card. This will allow you to choose the one that best suits your needs. Other benefits offered by different brands may be worth your time. A few credit cards offer a 0% introductory percentage rate for balance transfer, which can help to reduce your debt more quickly. You can also look for credit cards that offer travel protections.

Be aware of fees

Credit cards can offer a variety of benefits, but many have fees that can cut into the benefits. There are many fees associated with credit cards. These fees include balance transfer fees, fees for foreign transactions, annual fees, and expedited payments fees. Details can be found in the disclosure documents. You should carefully read these disclosure documents as they are often hidden fees.

There are many fees associated with credit cards. However, most credit cards include an annual fee. The annual fee can range from $95 to $500. While most fees are recurring, there are some credit cards companies that waive this fee for the first one year.