There are many credit cards available if you're looking for the best in 2020. These cards include high-tier rewards, balance transfer, student and interest-free cards. How do you know which card is the best? Based on our research, we have compiled a list with the top credit cards for 2020. You will find out what we mean. Using our methodology, we've sorted through hundreds of offers from more than 60 different companies.

Cards with interest-free financing

A number of attractive deals are available to new cardholders due to the intense competition among credit card issuers. Many of these deals are interest-free credit cards for an introductory period, which may last from 12 to 21 months. Although these deals are usually free of annual fees and balance transfer fees, they don't last forever. Once the introductory period is over, any remaining balance will begin accruing interest at the regular rate, which may be between 12 and 25 percent annually.

You can avoid paying interest on any new purchases by making sure you pay your entire balance each month. A low-interest card may be better if you have to make large purchases that are not regular monthly. These situations call for a low APR interest-free card. You can also opt for a 0% promotional period card if your monthly expenses are very low.

High-tier rewards cards

There are many rewards credit card options, but it is important to keep in mind that interest rate will continue rising throughout the year if your balance remains. The extended 0% introductory balance transfer window will allow you to save money this year. These deals are available for existing customers and not only new applicants. The 17 categories covered by our 51 selections of the best rewards credit card cards in 2020 include: With simple rules, they offer strong rewards on all purchases.

Chase Freedom Unlimited: This credit cards offers 5% cashback on pre-paid travel reservations and other purchases. You can also earn rewards at gas stations, restaurants and online. The cash back can be used to redeem any amount. You can use it to make a bank or account deposit. You can also use the cash back of 5% to purchase a gift voucher if you wish to give a charity gift. Additional perks are available with the Chase Freedom Unlimited cards. 100 dollars in statement credits will be available for eligible software subscriptions.

Student credit cards

One way to improve your credit score is by getting a student credit card. You can earn rewards such as air miles and store vouchers when you use your credit card responsibly. If you are unable to pay your monthly balance in full, your rewards will be meaningless. It may be that depending on your card issuer, rewards are only available if you spend responsibly. The following tips will help build your credit score.

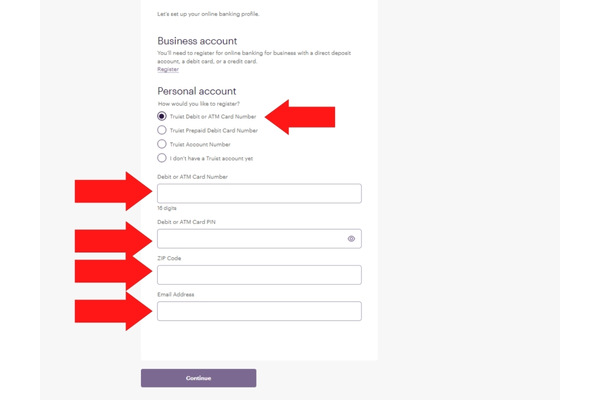

Before you apply for a card, it is important that you understand the various benefits and features provided by the company. You can get 1% cash back on your purchases with most student cards. Other cards may offer bonus rewards if payments are timely made and you spend a certain amount in the first few years of account opening. Most student cards are reported to all three major credit agencies. Making timely payments can help add years of positive information on your credit report.

Transfer cards for balances

Your credit score, your owes, and affordability are all important factors when evaluating balance transfer credit credit cards. These factors will impact which balance-transfer credit cards you choose. To make the process easier, we have compared hundreds of cards for their balance transfer appeal. There are five cards that don't have an annual fee and none that do.

The best thing about balance transfer credit cards? You can consolidate all your debt into one low monthly installment. You may be eligible for the best offers if your credit is excellent. Balance transfer cards that are the best come with an introductory period. After which, your balance is charged at a regular interest rate. Many offer small cash back rewards. Balance transfer credit cards can be a great option for those who want to quickly pay off their debt.