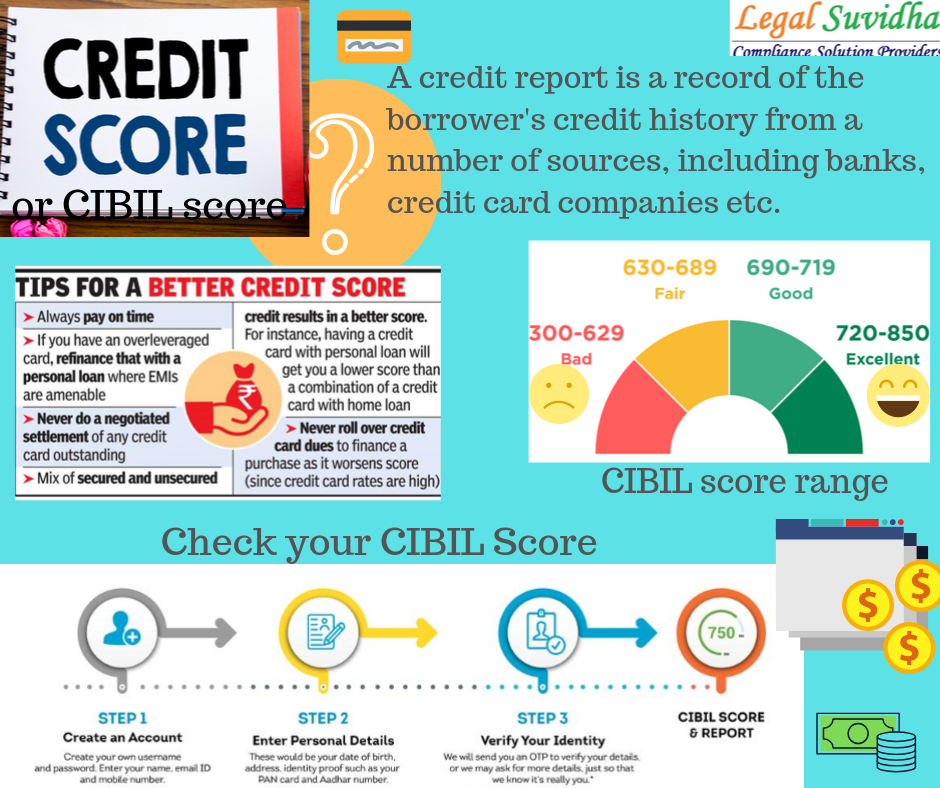

You must first know your credit score before applying for an instant credit card approval. A credit score of 750 or higher will get you approved for almost any card. A credit score of 620 and below could result in lower credit limits and higher interest rates. If your credit score is low, you may want to consider a secured credit card, where you must place some type of collateral, such as a car, house, or other asset. This collateral may be forfeited if you default on your payments.

WalletHub's Editors Picks for the Best Instant Approval Credit Cards

WalletHub editors sifted through over 1,000 credit card offers to determine the best instant approval credit lines for good credit. The terms and condition of each card was analyzed, along with other factors such rewards programs, annual fees, and approval requirements. To make it easier, they've grouped the cards according to category.

Capital One Quicksilver Secured cash Rewards Credit Card is a great choice for those with good credit. The card does not have an annual fee but you will need to make a refundable security deposit. This will reduce your spending limit. The card does not require a security deposit and offers excellent rewards. It can be approved instantly online.

You can also apply instantly for credit cards for those with poor credit. These cards offer a prequalification tool, which helps you to determine your chances and approval. Once you are approved, you will get an instant card number. Although these cards are approved quickly, it is not always easy. Every issuer will have different policies.

Comenity Bank

Comenity Bank offers many cards. Comenity Bank offers many credit cards. However, their primary focus is on store credit cards. They also offer high-yield savings accounts and certificates of deposits. Comenity Bank cards can help you build credit. Comenity Bank cards are available to anyone with a low credit score and can be linked to rewards programs offered by various retail partners.

Apply online to receive instant approval from Comenity Bank. Go to their website to view the offer and click on it. You can apply for a card by doing this without needing to provide your Social Security number. You will not be subject to a credit pull. Remember that once your application has been approved, the account will be visible on your credit report.

Whether you have excellent credit or bad credit, Comenity Bank offers a card that will meet your needs. The bank has over 135 partners, which makes it easy for you to find the card that suits your needs.

SoFi

You've found the right place if you have excellent credit and want to get a SoFi card. This credit card is accessible at many merchants and does not require pre-qualification. However, your credit score may play a role in whether you qualify. If you have a low credit score, it is possible to apply. However, having a higher score could increase your chances of being approved.

The SoFi credit card also allows you to earn points on your purchases. You earn two points for every dollar you spend on purchases. These points will be forfeited if your account is closed or you violate the terms. You can receive a reduced APR if you pay all of your minimum payments within 12 months.

You can also redeem your SoFi rewards for cash. Reward points can be used to fund your travel, investment, or budgeting. You can also redeem rewards for SoFi Savings and Checking accounts.