Creditworthiness

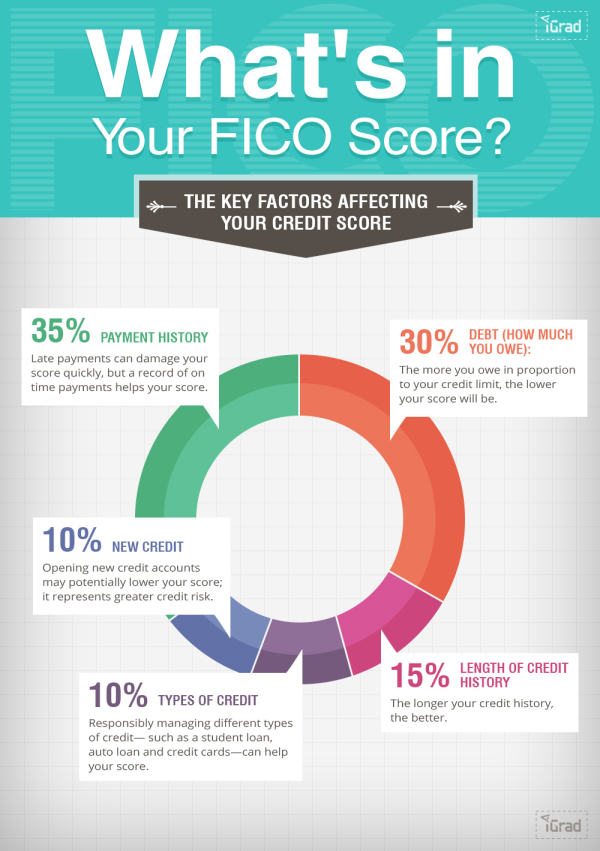

A good credit score of 680 will increase your chances of getting approved for a loan. This score is determined by your borrowing history. Your credit score can be improved by paying your bills in full and punctually. Don't max out your credit cards. Keep your available credit at 30%. It is best to not open too many credit cards at one time and to keep your old ones open.

Bad credit is often caused by poor money management, unexpected expenses, or poor financial planning. Job loss, car payments, and medical expenses can all add up and cause debt. You may be eligible for a loan if your credit score is between 679-679. However, the interest rate will likely be high.

Fair credit

Credit scores below 680 may make it hard to be approved for credit cards or loans. You can improve your credit score to have a better future. Knowing how to raise credit scores is the first step in building credit. The long-term benefits of this process are well worth the effort.

With a fair credit score of 680, you can be approved for many types credit cards and loans. Your chances of approval increasing are higher and you will get approved for lower interest rates and terms. This score is still below the "Good", but falls within the fair area. Over 35% of consumers have a score below 680.

Regular on-time payments can help you improve your score. After a certain amount of timely payments, many issuers automatically increase your credit limit. Even if your credit score has been good, it may be difficult to get approved for credit cards with rewards programs. There are some cards that can earn you cash back. However, rewards programs usually require exceptional credit.

The type of loan you need and your financial situation will affect whether you are eligible. You may have to pay higher interest rates or fees even if your credit score is good. You can request information to determine the reason you are not approved for a loan. You can also take steps that protect your rights.