An excellent way to build credit for young people is to open a check account with a bank. It will not negatively impact your credit rating but will help you when it comes time to borrow money. You should also consider getting a debit card to allow you to make purchases. Keep your balance positive to avoid paying insufficient funds charges. Some credit unions offer free checking accounts.

To build credit, limit the number of accounts you open

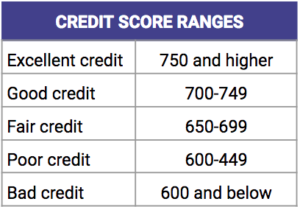

When you turn 18, one of the most important things that you can do is start building credit. A good credit score is essential for many aspects of adult life. This includes getting better rates on insurance and loans, as well as getting hired. It's also important to remember that your credit score is based on your payment history, so it's critical to make all payments on time.

Begin by limiting the number of new accounts you open. Limit the number of accounts that you open. This will avoid negative credit scores. The second step involves limiting the number of new accounts you can afford.

Automating payments to build credit

Building credit is a must as you pursue a high-paying career. You can build credit by saving as much money as you can and decreasing your debt. However, you will also need to keep an eye on your credit and make adjustments if necessary. It's possible to build credit before you turn 18, but it's not impossible.

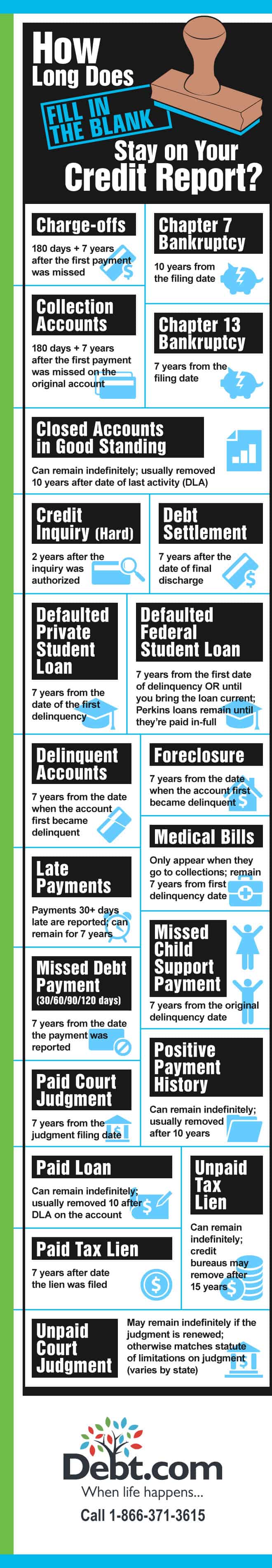

It is crucial to build a credit history early in life. Your score will indicate to lenders whether you are trustworthy. If you have good credit by 18, you may be eligible for student loans or low-interest loans. However, it is important to pay your bills on a regular basis. You should also remember that even one late payment could really affect your credit score.

A small loan is needed to improve credit.

It is vital to build credit as a young adult. To do this, one of your best options is to apply for small loans. You will be able show that you are able to manage money responsibly and establish a solid credit history. Getting a small loan at 18 will not hurt your credit score, but it is important to remember to pay your loan off on time.

A credit card can be an excellent way to establish credit. However, it can be hard for 18-years-olds to get one. You will need to provide proof of income and assets to be eligible for one. This can be difficult, since you don't have a history of making payments or building a credit rating. Also, it is possible that you still live with your parents and have very limited income. There are other ways to improve credit without a card.

Secured credit cards

If you are 18 years old and are interested in building your credit, getting a secured credit card may be an ideal solution. By paying an initial security deposit (which is often the credit limit for the card), these cards enable young people to start building credit histories. Afterward, if you maintain good payment patterns and repay your card balance on time, your credit history will quickly start building. You may be eligible for a regular unsecured or upgraded card.

Secured credit cards are very similar to unsecured cards. However, you need to make a deposit to cover your credit limit. The deposit is usually $200 to $2,000 and acts as a line of credit. This card can help you build credit and prepare you for applying for your first credit card. You can also add friends and family as authorized users on the card and make purchases. You remain responsible for making payments and keeping the balance low, so that you do not end up with a large balance.