Your credit score is critical when applying to for a loan. You need both installment and revolving credits. You can get revolving debt by opening a card and paying the minimum monthly payments. To avoid paying interest, make sure you only charge what your monthly budget allows. If you don't have any installment loans, you might want to consider taking out a small personal loan to demonstrate that you can handle different types of credit.

Mix of credit and good credit

There are many ways to get good credit. It is important to have an adequate amount of installment loans and revolving credit lines. However, there are other factors that can improve your credit score. These factors include making timely payments, maintaining low credit utilization, and refraining submitting too many credit applications at once.

Lenders will see your credit mix as a sign that you are trustworthy with multiple accounts. A diverse credit profile will make lenders more likely to approve your application for credit. This can lead to lower interest rates. This factor may not be as important as the other factors in credit scores, but it is important to have a strong credit mix to get approved for credit.

Mixing bad credit and good credit

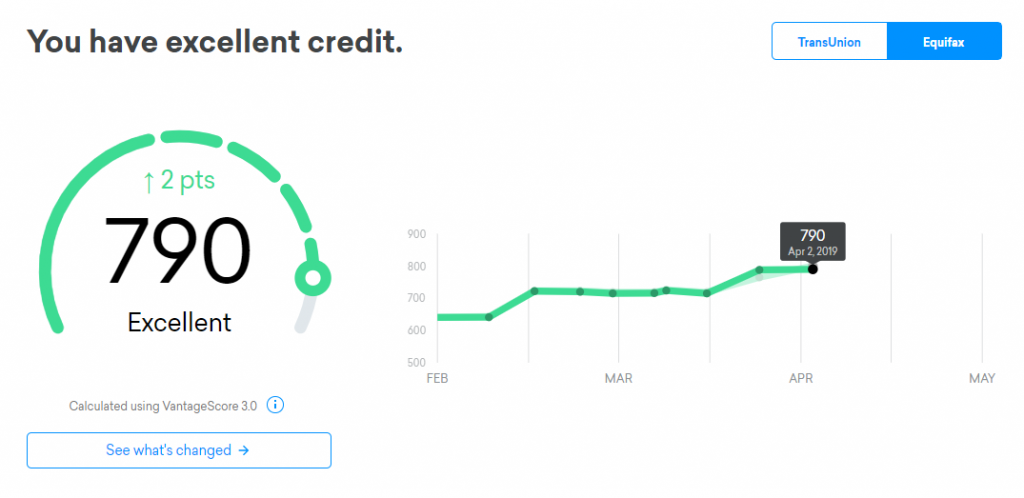

Bad credit history can result in a drop in credit score of up to 10%. This can lead to your being denied for credit or a reduction in your ability to obtain credit. Clix Capital, which offers free credit scores checks, is a good place to keep track of credit scores.

Poor credit scores can prevent you from getting a loan. But there are other options to help build your credit. You may be eligible for credit builder loans, which do not report back to the credit bureaus. These loans are very expensive and can add up to thousands of dollars in interest. It is better to improve your credit score by avoiding potential problems before they happen.

Credit history with long standing

Lenders look for long credit histories and credit that includes a variety of credit types when evaluating creditworthiness. This combination shows that you can pay off your bills and manage your debts. Credit mix can be a combination of installment, revolving and mortgage loans.

Your credit history is another factor. The higher your credit score, the better your credit history. Your credit score could be affected by accounts that you have closed recently. Closed accounts remain on credit reports for 10 years even if they are paid off in full.

New credit

Credit diversity is a key component of your credit score. Different types of credit can have different effects on your score. These include high-interest cards, auto loans, and high-interest card. This category may appear simple but there's more to it than meets your eye. Your score depends on the amount of new and old credit you have and the relationship between those accounts.

For credit building, you should have both installment and revolving accounts. You can use revolving credits in the most efficient way by opening a card and paying the minimum every month. To avoid accruing interest, ensure that you only charge the minimum monthly payment. A personal loan or line credit may be an option if your current credit is revolving. You'll be able to demonstrate your ability and willingness to accept different types of credit.

Credit utilization ratio

The credit utilization ratio is a measure of how much you owe compared to your available credit. The credit utilization ratio can be calculated by subtracting the total balance from your revolving account and multiplying it by the credit limit. You should keep this ratio below 30%. You should also pay more than you owe on your total credit limit.

A high credit utilization ratio will lower your credit score. Low credit utilization is also better for your credit score. According to Schulz, credit card users should have a utilization ratio of less than 30%. This is the threshold at where credit card usage can begin to impact credit scores. A credit card limit of $1,000 should be used to only allow $300 monthly charges.